Hello and Welcome to the Shergroupie Podcast! Listen to our Chief Shergroupie, Claire Sandbrook, talk about how Shergroup’s enforcement agents can help you by collecting your outstanding debt for you.

Shergroup was instructed to enforce a judgment against a director of a company at the director’s home address, or as in this storyline the former address of the director.

Directors of limited companies are usually protected from enforcement action at their homes because the judgment relates to the company and so enforcement needs to take place at the trading address or registered address of the company.

But the lines on this can be blurred when the company trades from the home address of the director.

In such a case, the director’s address becomes one of the “relevant premises” and enforcement agents can attend to that address to take goods of the company into legal control. Often Shergroup’s Complaints Officer will get involved in reviewing a case to ensure that Shergroup Enforcement Agents have followed the Taking Control of Goods Regulations, and the Best Practice of the High Court Enforcement Officers Association.

In this case, the judgment was entered on 16th June 2020 in the County Court Money Claims Centre.

Shergroup arranged to obtain the necessary certificate from the County Court for the debt to be transferred to the High Court for a Writ of Control to be issued. The Writ of Control was sealed on the 11th of November 2020 for an amount of £937.75 including costs of execution with interest accruing at 8% from the date of transfer.

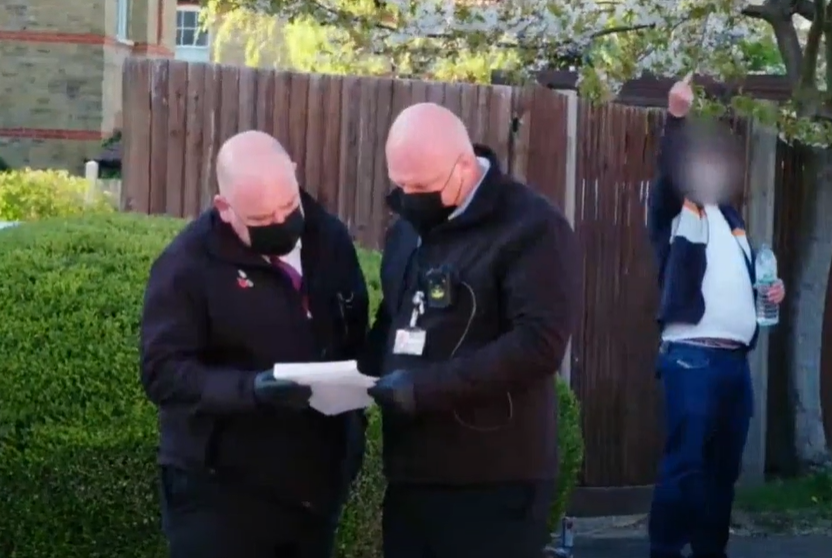

Enforcement Agents acting under the authority of Claire Sandbrook collected the amount in full, on the 4th visit to the property address. Between each attendance, Shergroup’s collections team made systematic calls to collect the outstanding balance by telephone. We take the view that we must reinforce the importance of our visits by agents, with reminders to the judgment debtor, or as in this case the directors of the judgment debt company, that the judgment needs to be paid.

The enforcement was made at the former director’s home, and his ex-wife did her best to help the enforcement agents in their enquiries. She made a call to her former husband so he couldn’t avoid the enforcement agents any longer. He made an offer which would have taken a year to pay off the debt and wasn’t accepted.

The agents gave him 15 minutes to come up with a better offer, or they would have to escalate the enforcement of the judgment to the next stage.

Agents Mark and Virgil also spotted open parcels addressed to the Judgment Debtor at the door of the address and again this just underlined the connection between the address on the Writ and that the company was doing business from this address. The ex-wife went on to share more insight when she explained that her former husband drove a new E-class Mercedes and she shared a new address for the director.

Armed with the new insight about the fact the director had a new luxury car the enforcement agents were not going to accept the next offer to come from the director. His offer of £200 then and there, and a monthly payment of £200 a month was rejected. He was warned that if he didn’t find the full amount the case would be escalated to the next stage and significant fees would be added to the Writ of Control. The director asked the agents to hold back for 20 minutes while he tried to arrange funds. Fortunately, these came through and he was able to pay the enforcement agents in full.

So do you find yourself in a similar situation with a debtor company and the directors playing for time please make use of our free review service at [email protected] or call us on 020 3588 4240 to discuss your situation in complete confidence?

You can email your unpaid CCJ to us to take a look at, along with any reports or information you have had from other enforcement providers. We will review all the information and give you our opinion on what your current options are. If we think everything that could have been done has been done, then we will tell you.

And if we think more could have been we will tell you what we think your options are.