If you are reading this guide it may be that you have a problem getting paid. Late payment is a real problem to business whether you be the owner, an in-house team or an advisor.

Everyone is looking for the best way to collect money from late paying customers, and here at Shergroup we get involved in the sharp end of collecting money by enforcing judgments.

This gives us a unique perspective to see how our clients have tried to collect payment before it even gets to us, and whether we can advise them on how to strengthen their procedures so that they don’t actually need to use us.

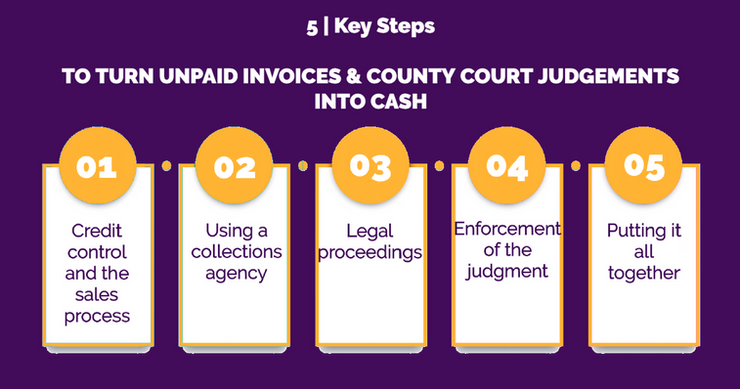

We are not worried about running out of work, because it’s the nature of business that there will always be judgments, and there will always be unpaid invoices. But what we can do is help you stop the easily recovered debts getting into our system, so that you use us to concentrate on more difficult unpaid situations. There are really only five key steps to getting your process right to collect payment.

Simply ask yourself these 5 questions, in sequence:

-

What does your internal sales and credit control process look like?

-

Do you outsource payment of your invoices to a specialist debt collection agency when you have exhausted your in-house procedures?

-

If none of that works, do you escalate unpaid invoices into legal proceedings so that you can compel your non-paying customer to pay you?

-

Have you found that legal proceedings have resulted in judgments being entered on your behalf, but these are still not paid?

-

Finally, have you had to resort to enforcement action to get paid – either by asking bailiffs to knock on the door, or taking other enforcement action, or even taking insolvency action against available assets?

Let’s have a look at how these five key steps fit together, and whether there is anything you can do with each of them to improve your chances of recovery.